Negotiable Certificate Of Deposit

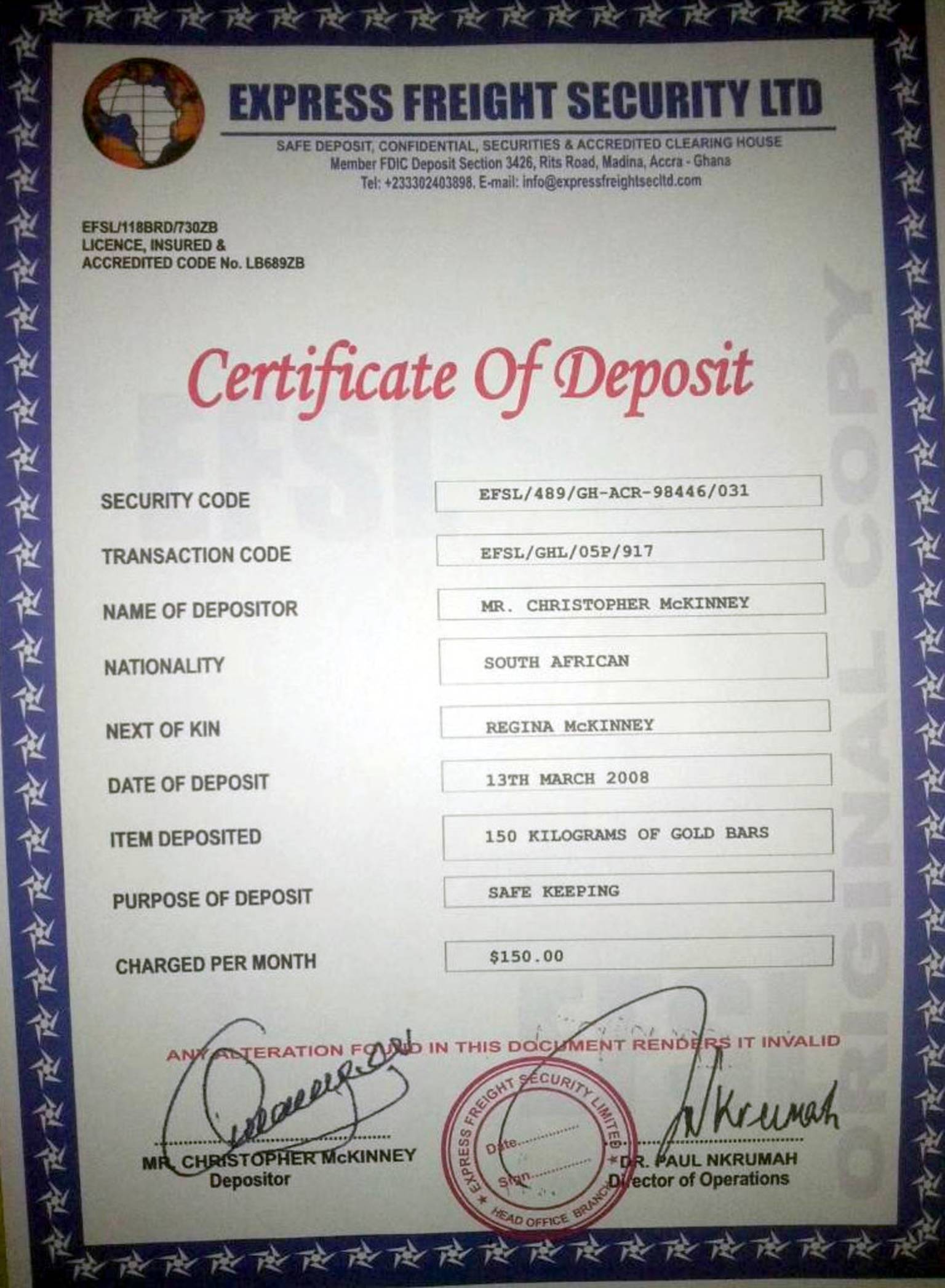

A negotiable certificate of deposit (NCD) is a certificate of deposit issued by the banks and it is freely negotiable unlike non-negotiable CDs which cannot be transferred, sold, bought, or exchanged. Negotiable certificates of deposit (negotiable CDs) are the most important source of purchased funds to U. Banks that are practitioners of liabilities man- agement. Moreover, they have become one of the.

Basically, the negotiable certificate of deposit (NCD) refers to the certificate of deposit with the minimum par value of although typically.

And NCDs carry a much higher face value. They are also known as jumbo CDs. And NCDs are guaranteed by the bank and can be traded in a highly-liquid secondary market.

However, they cannot redeem before maturity. Because NCDs are so large, they usually purchase by institutions and wealthy individual investors.

How Understanding Certificate of Deposits?

- The certificate of deposit (CD) refers to the product extended by banks, credit unions.

- Other financial lenders provide the specified interest rate to investors who leave the lump-sum deposit that cannot withdraw for the specific period.

- Virtually all financial institutions offer CD products with varying interest rates and time lengths.

- And CDs can consider a much safer investment alternative than bonds, stocks, real estate. And other asset classes due to the program interest rate that removes the volatility of returns.

- Also, opening the CD is much like opening a standard bank account. The main difference is that CD lock in the following aspects:

Also Read:What is a Controlled Business Arrangement in Real estate? – Definition, and More

1. The Interest Rate:

- The specific interest rate is lock in.

2. The Maturity Term:

- Length of time that the funds deposited are locked in.

What are the Advantages of Certificates of Deposit?

Negotiable Certificate Of Deposit (ncd)

- The certificates of deposits generally offer a higher interest rate than a savings account and money-market fund.

- And there are minimal risk and volatility associated with the return.

- And for most financial institutions, it is guarantee by the federal government.

What are the Disadvantages of Certificates of Deposit?

- The removal documentation does not settle before maturity without the penalty, and therefore, is very inflexible.

- And CDs generally earn a minor return than other asset classes.

- And the return is fix and can perform relative worse than other investments in a period of rising interest rates.

Also Read: How to Buy the Sign – Signage Buyer Guide? – 3 Signage Buyer Guide

Negotiable Certificate Of Deposit Malaysia